This comprehensive report delves into key market trends and drivers, highlighting the pivotal role of e-commerce warehouses in digital retail success amid booming online shopping. It examines cutting-edge technologies, including AI, robotics, and IoT, transforming warehouse operations. Additionally, the report explores tariff impacts, strategic shifts, and offers actionable insights for stakeholders.

Dublin, May 21, 2025 (GLOBE NEWSWIRE) — The “E-Commerce Warehouse – Global Strategic Business Report” has been added to ResearchAndMarkets.com’s offering.

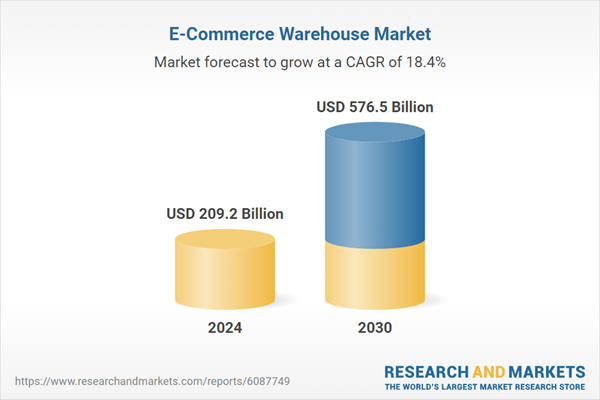

The global market for E-Commerce Warehouse was valued at US$209.2 Billion in 2024 and is projected to reach US$576.5 Billion by 2030, growing at a CAGR of 18.4% from 2024 to 2030.

This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions.

The report includes the most recent global tariff developments and how they impact the E-Commerce Warehouse market.

Why Are E-Commerce Warehouses Becoming Central to Digital Retail Success?

The explosion of online shopping has transformed logistics infrastructure, placing e-commerce warehouses at the heart of fulfillment ecosystems worldwide. Unlike traditional warehouses designed for bulk storage and long-term inventory holding, e-commerce warehouses are optimized for high-velocity order processing, real-time inventory visibility, and last-mile distribution efficiency. Their role has evolved from simple storage hubs to dynamic, technology-enabled fulfillment centers that support everything from same-day delivery to returns management and cross-border e-commerce. With the global e-commerce market projected to exceed $7 trillion by 2030, demand for high-performance warehousing has never been more critical.

The COVID-19 pandemic accelerated this shift by pushing millions of consumers online, forcing retailers to invest in decentralized warehouse networks closer to urban centers. This demand surge has created a boom in micro-fulfillment centers (MFCs), dark stores, and multi-client e-commerce hubs that allow retailers to fulfill orders with speed and precision. The need for omnichannel agility – supporting both online orders and brick-and-mortar replenishment – is further transforming warehouse configurations, layout planning, and operational workflows across the global retail landscape.

Which Segments and Geographies Are Driving Market Expansion?

The e-commerce warehouse market is expanding rapidly across both mature and emerging markets. North America and Europe are leading in warehouse automation adoption, with major investments from third-party logistics (3PL) providers, e-commerce giants like Amazon, Zalando, and Walmart, and real estate investment trusts (REITs) specializing in logistics facilities. In Asia-Pacific, particularly in China, India, and Southeast Asia, the market is growing due to rising middle-class consumption, mobile-first e-commerce behavior, and government investment in logistics corridors and smart cities.

Segment-wise, the fashion, consumer electronics, and beauty industries are leading adopters of advanced warehouse solutions due to high SKU turnover and the need for rapid delivery. The food and grocery segment is increasingly relying on cold-chain optimized e-commerce warehouses, while cross-border sellers on platforms like Alibaba, Shopify, and MercadoLibre are driving demand for bonded warehouses and customs-integrated hubs. SMEs and direct-to-consumer (DTC) brands are also entering the market by outsourcing warehousing to scalable 3PL partners, creating demand for flexible, subscription-based storage and fulfillment models.

What Is Driving Growth in the E-Commerce Warehouse Market?

The growth in the e-commerce warehouse market is driven by several factors related to digital retail acceleration, technological integration, and evolving consumer fulfillment expectations. The continuous rise of online shopping – particularly in emerging markets – is fueling demand for faster, more responsive warehousing capabilities. At the same time, technological advancements in robotics, WMS platforms, and AI-driven inventory management are enhancing warehouse efficiency and lowering operational costs.

End-use demand from omnichannel retailers, cross-border merchants, and online marketplaces is pushing warehouse providers to expand capacity, diversify services, and adopt modular, automated infrastructure. Urbanization and rising land scarcity are prompting investment in vertical warehouses and brownfield conversions, especially in dense metropolitan areas. Strategic interest from private equity and REITs, coupled with long-term e-commerce growth projections, is also driving capital investment into modern logistics real estate. These dynamics are positioning e-commerce warehouses as a foundational element of the future digital supply chain, with sustained global growth anticipated in the years ahead.

Report Scope

The report analyzes the E-Commerce Warehouse market, presented in terms of market value (US$ Thousand). The analysis covers the key segments outlined below:

Segments:

- Component (Hardware Equipment, Software)

- Product (Electronics, Apparel, Home Furnishing, Personal Care & Baby Products, Books, Other Products)

- Business Type (B2B, B2C)

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$398.5 Billion by 2030 with a CAGR of a 19.9%. The Software Component segment is also set to grow at 15.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $57.0 Billion in 2024, and China, forecasted to grow at an impressive 24.4% CAGR to reach $130.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agility Logistics, Alibaba Group (Cainiao), Amazon.com, Inc., Aramex, CEVA Logistics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Tariff Impact Analysis: Key Insights for 2025

Global tariff negotiations across 180+ countries are reshaping supply chains, costs, and competitiveness. This report reflects the latest developments as of April 2025 and incorporates forward-looking insights into the market outlook.

The analysts continuously track trade developments worldwide, drawing insights from leading global economists and over 200 industry and policy institutions, including think tanks, trade organizations, and national economic advisory bodies. This intelligence is integrated into forecasting models to provide timely, data-driven analysis of emerging risks and opportunities.

What’s Included in This Edition:

- Tariff-adjusted market forecasts by region and segment

- Analysis of cost and supply chain implications by sourcing and trade exposure

- Strategic insights into geographic shifts

Buyers receive a free 2025 update with:

- Finalized tariff impacts and new trade agreement effects

- Updated projections reflecting global sourcing and cost shifts

- Expanded country-specific coverage across the industry

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 380 |

| Forecast Period | 2024 – 2030 |

| Estimated Market Value (USD) in 2024 | $209.2 Billion |

| Forecasted Market Value (USD) by 2030 | $576.5 Billion |

| Compound Annual Growth Rate | 18.4% |

| Regions Covered | Global |

Key Topics Covered:

MARKET OVERVIEW

- World Market Trajectories

- E-Commerce Warehouse – Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence – Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

MARKET TRENDS & DRIVERS

- Exponential Growth in Online Shopping Drives Investment in High-Capacity E-Commerce Warehousing Facilities

- Last-Mile Delivery Optimization Spurs Development of Urban Micro-Warehouses and Fulfillment Hubs

- Automation and Robotics Integration Improves Throughput and Reduces Labor Dependence in Warehouses

- AI-Powered Inventory Management Systems Enable Predictive Restocking and Demand Forecasting

- Third-Party Logistics Providers (3PLs) Expand Fulfillment Networks for Direct-to-Consumer Brands

- Demand for Same-Day and Next-Day Shipping Services Fuels Growth in Regional Distribution Centers

- Omnichannel Retail Models Promote Use of Multi-Purpose Warehouses for B2B and B2C Fulfillment

- Sustainability Mandates Drive Adoption of Green Warehouse Design and Low-Carbon Operations

- Growth in Cold Chain E-Commerce Spurs Demand for Temperature-Controlled Warehouse Infrastructure

- Warehouse-as-a-Service (WaaS) Platforms Enable Flexible, Pay-Per-Use Storage for E-Retailers

- Integration of Cloud-Based WMS and ERP Systems Enhances Real-Time Warehouse Visibility

- Cross-Border E-Commerce Expansion Encourages Investment in Bonded and Duty-Free Warehouses

- Surge in E-Grocery Orders Elevates Need for Fast-Pick and Dark Store Warehouse Configurations

FOCUS ON SELECT PLAYERS

Some of the 44 companies featured in this E-Commerce Warehouse market report include:

- Agility Logistics

- Alibaba Group (Cainiao)

- Amazon

- Aramex

- CEVA Logistics

- DHL International

- eFulfillment Service

- FedEx Corporation

- GoBolt

- GXO Logistics

- JD Logistics

- Kenco Group

- Prologis

- Rakuten Super Logistics

- Red Stag Fulfillment

- Sea Limited (Shopee)

- SHIPHYPE Fulfillment

- ShipBob

- United Parcel Service (UPS)

- Ware2Go

For more information about this report visit https://www.researchandmarkets.com/r/6uwm47

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT:

CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900