Tariffs on imported luxury goods may initially impact sales in the U.S. Luxury Resale market, but consumers are shifting to the more budget-friendly resale market. Technology and sustainability trends are driving growth, with millennials and Gen Z favoring secondhand luxury to reduce environmental impact. Key players like The RealReal, thredUP, and eBay propel this fragmented market, offering authentic, premium alternatives through advanced digital platforms. The Southern region leads, supported by urbanization and thriving fashion culture.

Dublin, June 19, 2025 (GLOBE NEWSWIRE) — The “U.S. Luxury Resale Market Research Report 2025-2030” report has been added to ResearchAndMarkets.com’s offering.

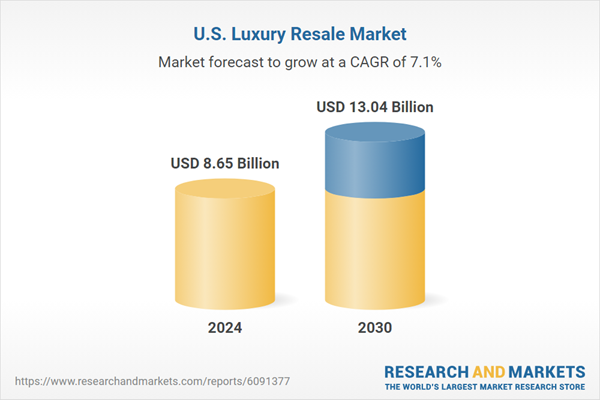

The U.S. Luxury Resale Market was valued at USD 8.65 billion in 2024, and is projected to reach USD 13.04 billion by 2030, rising at a CAGR of 7.08%.

In the U.S. luxury resale market, The Real Real, ThreadUp, and eBay are the key players, collectively accounting for a significant percentage of the market share. It is a fragmented market where resale platforms operate with large vendors, creating intense competition and offering a wide variety of second-hand luxury products to meet diverse customer preferences and budgets.

Furthermore, to maintain a competitive edge, companies are increasingly focusing on improving service models, authentication processes, and digital user experiences to meet the evolving expectations of both sellers and buyers.

LUXURY RESALE MARKET TRENDS

Investing In Exclusivity and Rarity

Exclusivity is the cornerstone of value in the luxury sector, a concept that drives consumer demand and commands premium prices. The luxury second-hand market results from consumers’ desire for distinctive, limited-edition products, sometimes unavailable through primary retail channels. The demand for rare goods is a major factor in resale platforms.

Collaborations Between Luxury Resale Platforms and High-End Fashion Brands

High-end fashion brands and luxury resale platforms have been collaborating, which reflects that they are adapting to changing consumer tastes. These collaborations strengthen the value and appeal of the brand as well as prolong the lifespan of luxury goods. For example, in 2023, thredUP and Luxury Handbag Reseller Rebag announced a partnership where Rebag customers can now resell gently-worn items on thredUP for Rebag shopping credit, and thredUP customers can shop select Rebag inventory directly on thredUP. By partnering with thredUP, Rebag is expanding the types of items its customers can send in. As part of the partnership, Rebag has launched a Clean Out program powered by thredUP’s Resale-as-a-Service (RaaS), which enables the world’s leading fashion brands and retailers to deliver customizable, scalable resale experiences to their customers.

Rise In Technology

Technology is playing a transformative role in shaping the luxury resale experience for customers. Technological innovations enhance the shopping experience and build customer trust in the market. In February 2025, Fashionphile debuted an augmented reality (AR) feature that allows customers to visualize products in their space before purchase. By enabling consumers to evaluate the way goods fit and look in their surroundings, this innovation enhances the online shopping experience and boosts consumer confidence when making purchases.

LUXURY RESALE MARKET ENABLERS

Millennials & Gen Z Influencing the Market

Millennials and Gen Z are major drivers of the U.S. luxury resale market. These generations are highly aware of the environmental impact of fast fashion and are more inclined to buy pre-owned luxury goods as part of their commitment to reducing waste and supporting sustainable practices. Most of the growth in the resale market has been driven by Gen Z shoppers looking for unique, economical, and sustainable buys.

Impact of Tariffs Driving the U.S. Luxury Resale Market

Tariffs are poised to increase the price of all sorts of goods, including apparel. The U.S. imports nearly all of its clothing and shoes from other countries, including from China, which is not exempt from the tariffs and now faces a rate of 145%. As rising tariffs continue to push up the prices of new apparel, consumers are actively seeking more affordable alternatives.

Rising Internet Penetration

The widespread internet access has facilitated the growth of online luxury resale platforms, enabling consumers to buy and sell pre-owned luxury items with greater ease. As of early 2024, the U.S. had approximately 331.1 million internet users, representing an internet penetration rate of 97.1% of the total population. High internet penetration is making it easier for individuals to browse, compare, and purchase luxury goods from the comfort of their homes.

Rising Demand for Sustainability

The U.S. luxury resale market is experiencing a significant shift towards sustainability, driven by evolving consumer preferences, economic factors, and industry innovations. Sustainability is becoming a more important consideration for customers, to lessen their influence on the environment, and more than half of these customers prefer to purchase used goods. With pre-owned luxury goods frequently costing 50-75% less than new ones, younger consumers want distinctive, premium products at more reasonable costs.

INDUSTRY RESTRAINTS

Challenges In Ensuring Authenticity

One of the key challenges in the U.S. luxury resale market is ensuring the authenticity of products. Counterfeit luxury goods can undermine trust in resale platforms and harm the reputation of brands. To address this, platforms like The RealReal and Poshmark are investing in sophisticated authentication processes, including expert appraisers, AI technology, and blockchain for traceability.

Unviable Growth of Secondhand Clothing

The rapid expansion of the second-hand clothing market raises concerns that it may weaken the primary market for new clothing. A significant decline in demand for new garments could increase production costs and slow innovation in textile manufacturing. This may also disrupt global supply chains, potentially limiting the future availability of high-quality second-hand items.

U.S. LUXURY RESALE MARKET REGIONAL ANALYSIS

The Southern U.S. holds the highest share of the U.S. luxury resale market, supported by its large and growing population, rising urban centers, and an expanding base of fashion-conscious and value-driven consumers. The region’s strong culture of social events, lifestyle spending, and aspirational purchasing fuels demand for luxury apparel, accessories, watches, and other items, both new and pre-owned. Furthermore, the Western region accounts for a significant share of the U.S. luxury resale market, supported by large urban populations and widespread use of digital resale platforms. Consumers in this region show consistent engagement with resale across both online and offline channels. Luxury resale platforms headquartered in the Western US, such as The RealReal (San Francisco), Poshmark (Redwood City), Rebag (Los Angeles), and Vestiaire Collective (San Francisco), have become integral to the region’s luxury resale market.

In the Midwest, growth is supported by the broader adoption of online resale platforms and a value-oriented consumer base. The rising number of affluent young professionals and urban dwellers in cities such as Chicago, Minneapolis, and Columbus is driving the demand for pre-owned luxury fashion, as consumers increasingly prioritize both value and sustainability when purchasing high-end goods. The Northeast accounted for the lowest revenue share in 2024 of the U.S. luxury resale market. New York remains a key driver for the Northeast luxury resale market, as the state not only hosts The RealReal’s flagship store in Soho, Manhattan, but also consistently ranks as one of the top states for both luxury item consignments and purchases on major platforms like Vestiaire Collective and The RealReal, reflecting the city’s deep-rooted fashion culture and high-end consumer base.

VENDOR LANDSCAPE

Key Developments in the United States Luxury Resale Market

- In 2024, The RealReal and Conservation International Unite for a Star-Studded Closet Sale. The company has launched its second star-studded sale in partnership with environmental leader Conservation International, featuring 230 luxury pieces consigned by influential women who have shaped fashion, journalism, social justice, and culture.

- In April 2025, eBay and Klarna Deepen Global Strategic Partnership to Empower Flexible Shopping in the U.S. The expanded partnership will give U.S. eBay shoppers more flexible and affordable ways to shop and pay.

Key Company Profiles

- eBay Inc.

- The RealReal

- ThreadUp Inc.

Other Prominent Company Profiles

- 1stDibs.com, Inc.

- Farfetch

- Heritage Auctions

- Poshmark, Inc.

- Most Wanted Luxury Resale

- NET-A-PORTER

- Rebag

- Reloved Luxury

- The Luxury Closet

- Vestiare Collective

- WGACA (What Goes Around Comes Around)

- Ziniosa

- Vinted

- LePrix, Inc.

- Yoogi’s Closet, Inc.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 114 |

| Forecast Period | 2024 – 2030 |

| Estimated Market Value (USD) in 2024 | $8.65 Billion |

| Forecasted Market Value (USD) by 2030 | $13.04 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | United States |

Key Topics Covered:

1. Scope & Coverage

2. Opportunity Pockets

3. Introduction

3.1. Impact of Tariff

4. Market Opportunities & Trends

4.1. Investing in Exclusivity and Rarity

4.2. Collaborations Between Luxury Resale Platforms and High-End Fashion Brands

4.3. Rise in Technology

5. Market Growth Enablers

5.1. Millennials & Gen Z Influencing the Market

5.2. Impact of Tariffs Driving the Luxury Resale Market

5.3. Rising Internet Penetration

6. Market Restraints

6.1. Challenges in Ensuring Authenticity

6.2. Unviable Growth of Secondhand Clothing

7. Market Landscape

7.1. Five Forces Analysis

8. Product Type (Market Size & Forecast: 2021-2030)

8.1. Handbags

8.2. Clothing

8.3. Shoes

8.4. Small Leather Goods

8.5. Watches

8.6. Jewelry

8.7. Accessories

9. Gender (Market Size & Forecast: 2021-2030)

9.1. Male

9.2. Female

10. Distribution Channel (Market Size & Forecast: 2021-2030)

10.1. Online

10.2. Offline

11. Geography (US)

11.1. South

11.2. West

11.3. Midwest

11.4. Northeast

12. Competitive Landscape

13. Competitive Overview

14. Key Company Profiles

15. Other Prominent Company Profiles

16. Report Summary

For more information about this report visit https://www.researchandmarkets.com/r/s5vylr

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900