Africa’s prepaid card and digital wallet market is set to expand at a 13.3% CAGR from 2025-2029, reaching $59.4 billion. Growth is fueled by digital adoption, financial inclusion, and mobile money integrations, transforming access for unbanked populations.

Dublin, June 19, 2025 (GLOBE NEWSWIRE) — The “Africa Prepaid Card and Digital Wallet Market Intelligence and Future Growth Dynamics Databook – Q2 2025 Update” has been added to ResearchAndMarkets.com’s offering.

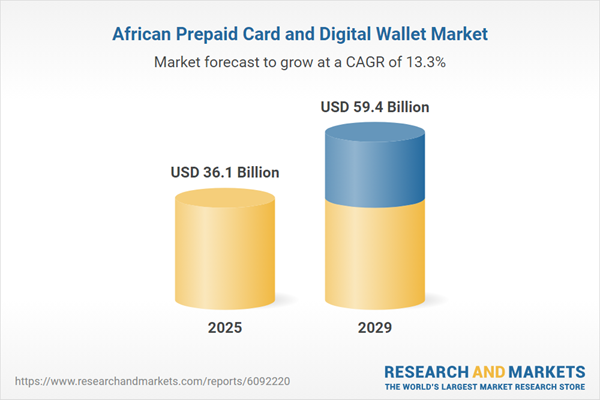

The prepaid card and digital wallet market in Africa is poised for substantial growth, with projections indicating an annual increase of 16.1%, reaching USD 36.1 billion by 2025. Between 2020 and 2024, this market achieved a CAGR of 18.8% and is expected to continue its upward trajectory with a CAGR of 13.3% from 2025 to 2029, expanding from USD 31.1 billion in 2024 to approximately USD 59.4 billion by 2029.

Key Trends and Drivers

The transformation of Africa’s prepaid card sector is driven by the adoption of digital financial services and financial inclusion initiatives. Enhanced digital wallet solutions and prepaid card-linked services are bridging the gap for unbanked and underbanked populations, facilitating more inclusive financial transactions. The market is also experiencing growth in prepaid card solutions aimed at younger demographics, fostering financial literacy and encouraging early adoption of digital financial tools.

The integration of prepaid cards with mobile money platforms will enhance cross-border payment capabilities, leading to seamless transactions across African markets. This development is bolstered by regulatory support and strategic collaborations among telecom operators, fintech companies, and financial institutions.

Expansion of Digital Wallets and Prepaid Card Usage

- Digital wallets linked to prepaid cards are seeing significant adoption. South Africa’s SOLmate reported a 100% annual increase in its user base, while Nigeria’s Wallets Africa has launched a multi-currency wallet with over 250,000 users.

- Unbanked and underbanked populations drive demand for accessible financial services, prompting fintech companies to offer digital wallets and prepaid cards that facilitate online transactions and fund transfers without traditional banking.

- Expansion of these services is expected, with fintech firms extending offerings and reaching larger user bases.

Growth in Teen-Focused Prepaid Card Solutions

- There is a notably rising focus on prepaid card solutions designed for teenagers. Companies like Zywa are offering platforms for teenagers to learn financial management, raising significant funding for expansion.

- The uptake is driven by the need for financial products catering to Gen Z, as well as educational tools for financial management.

Integration with Mobile Money Platforms

- Telecommunications companies are integrating prepaid cards with mobile money to improve financial services, leveraging the widespread use of mobile money in Africa.

- Such integrations promise enhanced cross-border transaction capabilities and global payment system access.

Competitive Landscape

The prepaid card market is rapidly evolving with technological advances and policy developments. Both established financial institutions and innovative fintech firms contribute to a competitive environment, driving market consolidation through strategic partnerships and mergers. Companies that are agile in regulatory compliance and security will likely secure greater market shares.

Current Dynamics and Market Evolution

- Government policies advocating cashless economies fuel the expansion, with prepaid cards enhancing e-commerce, payroll systems, and government disbursements.

- Strategic partnerships and acquisitions remain pivotal in expanding distribution networks and enhancing product offerings.

As competition intensifies, innovation in services such as loyalty programs and cross-border solutions will drive further market adoption, especially in sectors like remittances and online commerce.

Regulatory Changes

- Regulatory changes across Africa enhance transparency and consumer protection, with reforms like extended expiry periods for gift cards and clearer fee structures.

- Fraud prevention and AML regulations aim to ensure a secure prepaid card ecosystem, promoting confidence among consumers.

This report, based on the publisher’s proprietary analytics platform, offers an unbiased, comprehensive analysis of market opportunities across prepaid and digital wallet domains in Africa, delving into detailed metrics such as transaction values and segment-specific insights.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 954 |

| Forecast Period | 2025 – 2029 |

| Estimated Market Value (USD) in 2025 | $36.1 Billion |

| Forecasted Market Value (USD) by 2029 | $59.4 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Africa |

Key Topics Covered:

- Prepaid Payment Instrument Market Size and Future Growth Dynamics by Key Performance Indicators

- Transaction Value Trend Analysis, 2020 – 2029

- Transaction Volume Trend Analysis, 2020 – 2029

- Average Value per Transaction, 2020 – 2029

- Market Share Analysis by Prepaid Card vs. Digital Wallet, 2020 – 2029

- Digital Wallet Market Size and Future Growth Dynamics by Key Performance Indicators, 2020 – 2029

- Transaction Value Trend Analysis, 2020 – 2029

- Average Value per Transaction, 2020 – 2029

- Transaction Volume Trend Analysis, 2020 – 2029

- Market Share Analysis by Key Segments

- Retail Payments Market Size and Future Growth Dynamics by Key Performance Indicators

- Travel Payments Market Size and Future Growth Dynamics by Key Performance Indicators, 2020 – 2029

- Restaurants & Bars Payments Market Size and Future Growth Dynamics by Key Performance Indicators

- Entertainment, Gaming, & Event Payments Market Size and Future Growth Dynamics by Key Performance Indicators

- Recharge and Bill Payments Market Size and Future Growth Dynamics by Key Performance Indicators

- Market Share Analysis by Key Retail Categories, 2024

- Food and Grocery – Transaction Value Trend Analysis, 2020 – 2029

- Health and Beauty Products – Transaction Value Trend Analysis, 2020 – 2029

- Apparel and Foot Wear – Transaction Value Trend Analysis, 2020 – 2029

- Books, Music and Video – Transaction Value Trend Analysis, 2020 – 2029

- Consumer Electronics – Transaction Value Trend Analysis, 2020 – 2029

- Pharmacy and Wellness – Transaction Value Trend Analysis, 2020 – 2029

- Gas Stations – Transaction Value Trend Analysis, 2020 – 2029

- Restaurants & Bars – Transaction Value Trend Analysis, 2020 – 2029

- Toys, Kids, and Baby Products – Transaction Value Trend Analysis, 2020 – 2029

- Services – Transaction Value Trend Analysis, 2020 – 2029

- Others – Transaction Value Trend Analysis, 2020 – 2029

- Market Size and Future Growth Dynamics by Key Performance Indicators

- Market Share Analysis by Functional Attributes – Open Loop vs. Closed Loop, 2020 – 2029

- Market Share Analysis by Prepaid Card Categories

- Trend Analysis by Key Performance Indicators

- Trend Analysis by Key Performance Indicators

- Prepaid Card Consumer Usage Trends

- Prepaid Card Retail Spend Dynamics

- General Purpose Prepaid Card Market Size and Forecast, 2020 – 2029

- Gift Card Market Size and Forecast, 2020 – 2029

- Entertainment and Gaming Prepaid Card Market Size and Forecast, 2020 – 2029

- Teen and Campus Prepaid Card Market Size and Forecast, 2020 – 2029

- Business and Administrative Expense Prepaid Card Market Size and Forecast, 2020 – 2029

- Payroll Prepaid Card Market Size and Forecast, 2020-2029

- Meal Prepaid Card Market Size and Forecast, 2020-2029

- Travel Forex Prepaid Card Market Size and Forecast, 2020-2029

- Transit and Tolls Prepaid Card Market Size and Forecast, 2020-2029

- Social Security and Other Government Benefit Programs Prepaid Card Market Size and Forecast, 2020-2029

- Fuel Prepaid Cards Market Size and Forecast, 2020-2029

- Utilities, and Other Prepaid Cards Market Size and Forecast, 2020-2029

- Virtual Prepaid Card Industry Market Attractiveness, 2020-2029

- Virtual Prepaid Card Market Size and Future Growth Dynamics by Key Categories, 2020-2029

For more information about this report visit https://www.researchandmarkets.com/r/5y9g29

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900