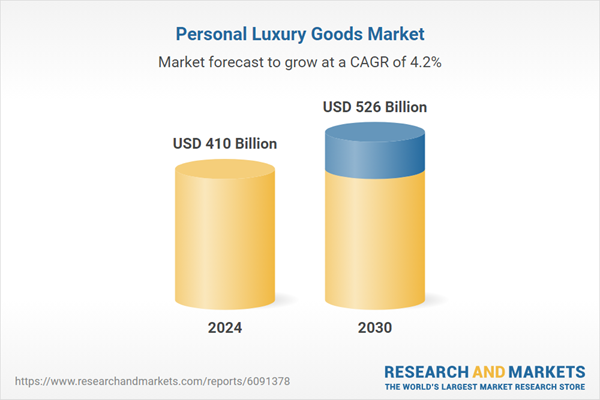

The global personal luxury goods market, valued at USD 410 billion in 2024, is projected to reach USD 526 billion by 2030, growing at a CAGR of 4.24%. The U.S.-China trade war poses challenges, impacting costs and availability. Key trends include circular economy initiatives, online retail strategies, and urban demand in emerging markets. Segment growth varies, with watches and jewelry leading, while beauty and fragrances witness fastest growth. APAC remains the dominant region, driven by urbanization and digital retail transformation. Major players like LVMH and Rolex leverage strategic partnerships and innovation to maintain market positioning.

Dublin, July 01, 2025 (GLOBE NEWSWIRE) — The “Personal Luxury Goods Market Research Report 2025-2030” report has been added to ResearchAndMarkets.com’s offering.

The Personal Luxury Goods Market was valued at USD 410 billion in 2024, and is projected to reach USD 526 billion by 2030, rising at a CAGR of 4.24%.

The global personal luxury goods market is fragmented and characterized by numerous manufacturers that hold modest market share. Key players, including LVH, Prada Group, Rolex, Kering, and Richemont, among others, have established dominance in the market by continuously innovating and expanding their product offerings. Major vendors are strategically implementing innovative technologies to maintain their market positions. For instance, in 2023, Burberry introduced its virtual store by partnering with Blankos Block Party, a gaming platform, and offering interactive product discovery.

The companies in the personal luxury goods industry are also focusing on several strategic partnerships with other providers to ensure continuous supply chains and manufacturing capabilities. For instance, in 2023, Kering completed a 30% acquisition of the Italian luxury fashion house Valentino. The partnership is between Valentino’s parent company, Mayhoola, and it has also provided an option for Kering to acquire the remaining 70% by 2028.

The leaders in the personal luxury goods market are making significant R&D investments to enhance the availability and differentiation of their products. For instance, in 2024, Richemont acquired Vhernier, which is an Italian jewelry brand, to enhance its Jewelry Maisons division. Furthermore, companies are increasingly expanding their product range and strengthening their market positions through acquisitions and partnerships. For instance, in 2024, Lavie Luxe launched its new 18% fragrance concentration perfume line, featuring four Eau de Parfum fragrances named LUSH, LILY, LAGOON, and LOVE.

Consumers are increasingly interested in luxury goods that are designed with circular economic principles, such as those that can be easily upcycled. Gucci was the first luxury brand to use ECONYL recycled nylon in ready-wear pieces, which is a 100% recycled nylon derived from fishing nets, textile waste, and a thick pile fabric used for carpets and upholstery.

Luxury brands have increasingly adopted online approaches to meet evolving consumer expectations. For instance, in 2023, Dior was the most popular luxury brand online because of its strategic investments in digital marketing, e-commerce, and social media engagement. This approach helped the brand to engage a wider audience, which has boosted its online sales, especially in markets like China and the US.

Brands strategically position themselves to capture renewed demand from urban areas. For instance, Dior expanded its Dioriviera pop-up shops in places like Bali and Phuket. It has created immersive experiences that resonate with travelers seeking exclusivity. Hence, such factors are supporting the demand for the personal luxury goods market across emerging nations.

As the global economies continue to grow, disposable income levels rise, leading to increased spending on luxury items like footwear. Consumers are increasingly inclined towards luxury footwear because of changing lifestyles and fashion trends. Luxury footwear companies are focusing on the growing consumer base in developing countries such as India and other Southeast Asian countries, where wealth and demand for luxury goods are rising. In 2022, Louis Vuitton introduced its exclusive footwear collection for the Indian market, which features new colors like Rani Pink and glittering designs for celebrating India’s cultural heritage.

Urbanization in emerging markets such as China, India, and Southeast Asia continues to drive demand for the personal luxury goods market. In India, platforms like Luxepolis have significantly supported the development of the market by offering new and pre-owned luxury items to a growing audience in smaller cities, as the growing urban population increases the demand for high-end items. Brands are strategically positioning themselves to capture renewed demand from urban areas. For instance, Dior expanded its Dioriviera pop-up shops to places like Bali and Phuket. Additionally, collaborations between fashion houses and hospitality venues such as Fendi’s beach club in Marbella have created immersive experiences that resonate with travelers seeking exclusivity.

INDUSTRY RESTRAINTS

The disruption in the supply chain has led to increased costs for raw materials, logistics, and transportation, which have raised operational costs and are often passed on to end consumers which leading to higher luxury goods prices. The focus on limited production to maintain exclusivity significantly raises the production costs for luxury brands. Brands often face higher unit costs for manufacturing, sourcing premium materials, and utilizing skilled labor for producing limited edition items.

This limits scalability and hampers the personal luxury goods market demand. Furthermore, major brands occasionally face backlash for products or marketing campaigns, such as Louis Vuitton for selling a scarf inspired by the Palestinian keffiyeh and a jacket that seems to present Jamaican culture by using the country’s flags but incorrectly represented. These factors hamper the brand value and show the need for careful consideration in global marketing efforts.

PERSONAL LUXURY GOODS MARKET GEOGRAPHICAL ANALYSIS

The APAC region dominated the global personal luxury goods market, accounting for a share of over 38% in 2024. APAC is experiencing a surge in urbanization and rising disposable income, particularly in countries like China, India, and Southeast Asian countries. A growing middle and upper-middle class is driving demand for luxury goods as markers of status, success, and aspiration. As consumers become more brand-conscious, luxury ownership is increasingly viewed as a symbol of achievement. Furthermore, with the rising digital transformation in luxury retail, the region is experiencing steady growth. Livestream shopping, influencer-led marketing, and virtual brand experiences are reshaping the region’s personal luxury goods market. This has made luxury more accessible and engaging to younger consumers.

The North American personal luxury goods market is highly competitive as it consists of several major vendors such as LVMH and Chanel, among others, which cater to customers worldwide. The robust cosmetic industry across the U.S. further supports the market growth. Furthermore, the European personal luxury goods market is growing at a growth rate of 2.53% during the forecast period owing to the presence large number of high-net-worth individuals. Germany, the UK, and France are the major contributors to the European market. The market increases on tourism with cities like Paris, Milan, and London, which are global shopping hubs. Tourists, especially from Asia and the Middle East, contribute significantly to luxury sales, seeking authentic European luxury experiences. Exclusive in-store collections, tax-free shopping, and iconic flagship boutiques further enhance Europe’s appeal as a luxury destination.

The Latin American personal luxury goods market experiences a significant transformation with the growing adoption of digital technologies and the expansion of luxury brands across the region. Brazil and Mexico lead the regional market with substantial investments in e-commerce infrastructure and premium retail spaces. Furthermore, the Middle East & Africa is having emerging opportunities in the personal luxury goods industry because of the rapidly growing e-commerce industry and increasing disposable income. Major players are focusing on introducing new product offerings in the market to cater to the interests of consumers as per ongoing fashion trends among goods, like footwear, accessories, and luggage bags. For instance, in 2021, Rolex opened its store at the Galleria Al Maryah Island in Abu Dhabi, featuring a watch bar with a VIP room that proudly displays the extensive collection.

VENDOR LANDSCAPE

- In 2025, Hermes launched the Rouge Hermes Silky Lipstick Shine, a luxurious lipstick inspired by the brand’s iconic silk scarves.

- In 2025, Jil Sander launched its first luxury fragrance collection, the Olfactory Series 1, by collaborating with Coty.

- In 2024, Dolce & Gabbana ventured into pet luxury by introducing Fefe, which is a perfume designed specifically for dogs.

- In 2024, Louis Vuitton launched its Metaverse Bag, integrated with AR features, allowing users to interact with the digital version of the handbag via mobile applications.

- In 2023, Swarovski Created Diamonds launched its Galaxy collection across the U.S. and Canada, which is an exquisite line inspired by cosmic phenomena and designed by Global Creative Director Giovanna Engelbert.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 210 |

| Forecast Period | 2024 – 2030 |

| Estimated Market Value (USD) in 2024 | $410 Billion |

| Forecasted Market Value (USD) by 2030 | $526 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

Market Dynamics

Recent Developments

- Consumer Preference Analysis

- Comparative Market Shift Analysis

- Impact of the Ongoing Tariff War

Market Opportunities & Trends

- Increasing Demand for Sustainable Luxury Goods

- Growing Popularity of Online Luxury Retail

- Expansion of Luxury Brands into New Geographies

- Technological Advancements

Market Growth Enablers

- Urbanization & Global Tourism Recovery

- Expansion into New Product Demographics

- Emerging Luxury Beauty Industry

- Growing Luxury Footwear Market

Market Restraints

- Economic Uncertainty and Inflationary Pressures

- Limited Production and Exclusivity

- Supply Chain Disruptions

- Evolving Customer Expectations

Market Landscape

- Five Forces Analysis

Key Company Profiles

- LVMH

- Kering

- Richemont

- Hermes

- Rolex

- The Estee Lauder Companies Inc.

- Prada Group

- The Swatch Group Ltd

- Signet Jewelers

- Pandora

Other Prominent Company Profiles

- Cartier

- Harry Winston

- CAPRI HOLDINGS

- Armani Group

- L’Oreal Group

- Charlotte Tilbury

- Chow Tai Fook Jewellery Company Limited

- Swarovski

- Burberry

- Valentino

- Ralph Lauren Corporation

- Calvin Klein

- SK-II

- Lancome

- David Yurman

- Grown Brilliance

- ALEX AND ANI

- Alexis Bittar

- BaubleBar

- Ben-Amun

- Brilliant Earth

- Catbird

- Chanel

- Chan Luu

- Dorsey

- Fantasia by DeSerio

- Gorjana

- Graff

- Ippolita

- John Hardy

For more information about this report visit https://www.researchandmarkets.com/r/qkn6fd

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900