The UAE automotive coatings market benefits from rising vehicle customization demands, economic growth, and high disposable incomes, driving interest in durable, aesthetic coatings. The push toward eco-friendly solutions like waterborne coatings aligns with sustainability trends, while challenges include raw material cost volatility.

Dublin, Oct. 06, 2025 (GLOBE NEWSWIRE) — The “UAE Automotive Coatings Market, By Region, Competition, Forecast & Opportunities, 2020-2030F” has been added to ResearchAndMarkets.com’s offering.

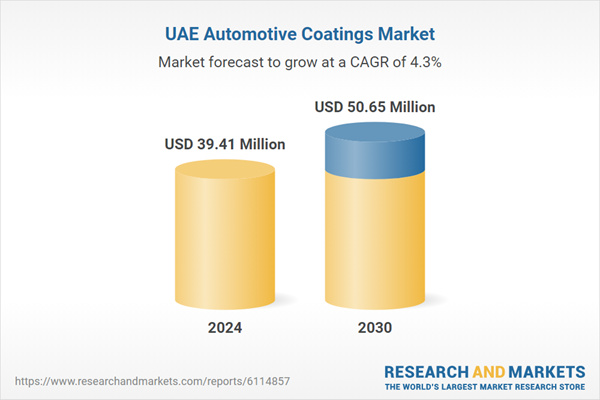

The UAE Automotive Coatings Market was valued at USD 39.41 Million in 2024, and is expected to reach USD 50.65 Million by 2030, rising at a CAGR of 4.27%.

The UAE automotive coatings market is experiencing strong momentum, fueled by a growing economy and increasing disposable income. For instance, the UAE economy is projected to grow by 4.7% in 2025 and accelerate to 5.7% in 2026, supported by robust performance in both hydrocarbon and non-oil sectors such as tourism, real estate, manufacturing, and trade. Non-oil GDP is expected to rise by 5.1%, while inflation remains controlled at 2.0% due to stable domestic prices and easing global tradables inflation.

Strong fiscal health is reflected in a USD 26.22 billion surplus during the first three quarters of 2024, fueled by rising tax revenues. A 6.7% year-on-year increase in wages and expanding employment are further bolstering household consumption.

The growing emphasis on vehicle maintenance and protection against harsh environmental elements is encouraging the adoption of advanced coating solutions, including waterborne and UV-cured variants. Increased vehicle production, combined with a surge in luxury and premium car sales, is elevating the demand for high-performance coatings that offer durability. For instance, in Q1 2025, the UAE vehicle market recorded a 13.8% year-on-year increase, reflecting strong economic stability and rising consumer confidence. January led with a sharp 22.3% surge, followed by 11.5% growth in February, while March maintained momentum with a 7.7% rise, indicating sustained demand across the quarter.

Market Drivers: Increasing Demand for Aesthetic Vehicle Customization

The rising consumer inclination toward visually appealing vehicles is significantly propelling the demand for automotive coatings. Buyers are increasingly treating vehicles as an extension of personal style, driving the uptake of customized paint jobs, special-effect finishes, and metallic or pearlescent coatings. This trend is being embraced by both original equipment manufacturers (OEMs) and aftermarket service providers, offering a wide palette of colors and textures that enhance vehicle identity and uniqueness.

Automotive coatings that offer high gloss, depth, and advanced color shifting are in demand to satisfy evolving consumer tastes. Moreover, car owners are investing in coatings that provide not just beauty but also protection, creating a dual-value proposition. The growing popularity of shared mobility and leasing models is also boosting demand for visually attractive and well-maintained vehicles, as appearance directly impacts resale or rental value. Paint protection films and clear coats are gaining traction for their ability to preserve the finish over time.

Key Market Challenges: High Raw Material Costs and Price Volatility

Raw materials used in automotive coatings, such as resins, pigments, solvents, and additives, are subject to significant price fluctuations, largely driven by petrochemical market dynamics. These cost instabilities directly impact profit margins for manufacturers, especially those operating under fixed-price OEM contracts or competing in price-sensitive aftermarket segments. The reliance on fossil-derived feedstocks for core ingredients like polyurethanes and acrylics creates exposure to geopolitical and supply chain disruptions. As demand increases for more advanced and multi-functional coatings, the need for specialized additives and performance enhancers further escalates costs. Manufacturers often struggle to pass on these increased costs to customers due to competitive pressure, leading to thinner margins and reduced R&D investment capacity.

Key Market Trends: Shift Toward Waterborne and Eco-Friendly Coatings

Sustainability concerns and regulatory mandates are accelerating the shift toward waterborne and environmentally friendly coatings in the automobile industry. Waterborne coatings, which use water as the primary solvent instead of traditional petroleum-based chemicals, offer significant reductions in VOC emissions and toxic air pollutants. These formulations are gaining popularity among OEMs and aftermarket players seeking to align with green manufacturing standards and corporate sustainability goals. Eco-friendly coatings not only reduce environmental footprint during application but also enhance worker safety and operational compliance.

Technological improvements have closed earlier performance gaps, allowing waterborne systems to match or even exceed solvent-borne coatings in terms of gloss, durability, and curing times. Manufacturers are also exploring bio-based binders, low-energy curing methods, and recyclable packaging as part of broader environmental responsibility strategies. This trend is reinforced by growing consumer awareness of eco-conscious products, which influences purchasing decisions.

Key Market Players:

- Delta Gulf Paints

- Shaji Auto Paints Trading

- Wellcoat Paints

- Al Danawi Stores

- Mega Paints Trading

- Al Mayar Coatings

- Kansai Paint Middle East

- Al Alwan Al Sehriah Auto Paint Trdg

- Abdul Rahman Car Paints Co

- KCC Corporation

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 85 |

| Forecast Period | 2024 – 2030 |

| Estimated Market Value (USD) in 2024 | $39.41 Million |

| Forecasted Market Value (USD) by 2030 | $50.65 Million |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | United Arab Emirates |

Report Scope:

In this report, the UAE Automotive Coatings Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

UAE Automotive Coatings Market, By Resin Type:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

UAE Automotive Coatings Market, By Technology:

- Water-Borne

- Solvent-Borne

- Powder Coating

- Others

UAE Automotive Coatings Market, By Vehicle Type:

- Passenger Car

- Commercial Vehicle

- Two-Wheeler

UAE Automotive Coatings Market, By Application:

- Primer

- Clearcoat

- Basecoat

- Others

UAE Automotive Coatings Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

For more information about this report visit https://www.researchandmarkets.com/r/s7dcy

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT:

CONTACT: ResearchAndMarkets.com

Laura Wood,Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900