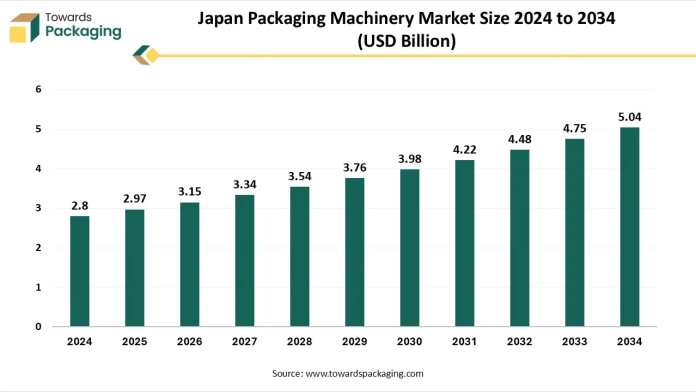

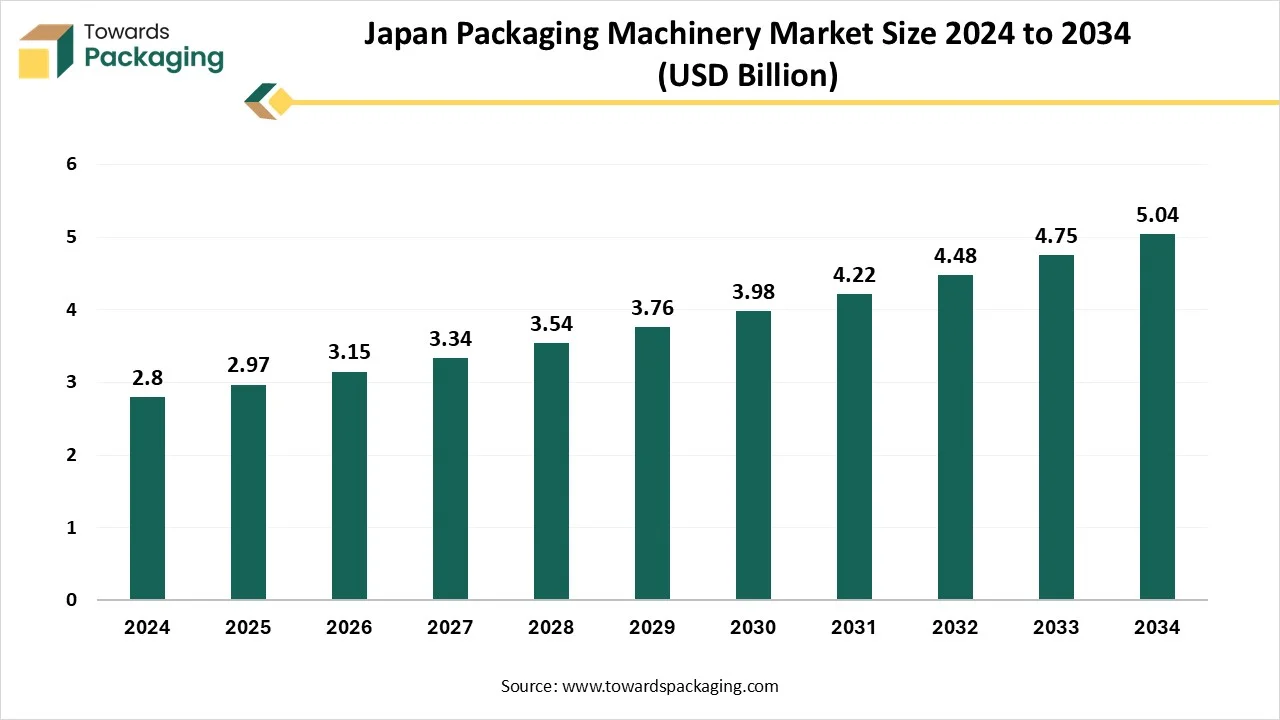

As highlighted by Towards Packaging research, the global Japan packaging machinery market, valued at USD 2.97 billion in 2025, is expected to reach USD 5.04 billion by 2034, registering a CAGR of 6.05% throughout the forecast period.

Ottawa, Oct. 24, 2025 (GLOBE NEWSWIRE) — The global Japan packaging machinery market, valued at USD 2.97 billion in 2025, is expected to rise to approximately USD 5.04 billion in 2034, based on a report published by Towards Packaging, a sister firm of Precedence Research.

The market is experiencing significant growth, driven by rising demand for automation, efficiency, and precision in manufacturing processes. Rising adoption of advanced technologies such as robotics, IoT integration, and smart packaging solutions is enhancing productivity and quality standards.

The rapid expansion of the food & beverages, pharmaceutical, and cosmetics industries is fueling the need for innovative packaging machinery. Additionally, the emphasis on sustainability and eco-friendly packaging materials is encouraging manufacturers to develop energy-efficient and flexible machinery to meet evolving industry needs.

Get All the Details in Our Solutions – Access Report Sample: https://www.towardspackaging.com/download-sample/5708

What is Meant by Packaging Machinery?

Packaging machinery encompasses a wide range of equipment used to complete various stages of the packaging process, ensuring that products are safely and efficiently prepared for distribution and sale. These machines perform various functions, including filling, sealing, labeling, wrapping, coding, and palletizing, across industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods. Modern packaging machinery integrates automation, robotics, and digital technologies to improve speed, precision, and consistency, while reducing human error. Additionally, advanced systems support customization, eco-friendly packaging materials, and compliance with safety and regulatory standards, making them essential in today’s competitive manufacturing environment.

What are the Latest Trends in the Japan Packaging Machinery Market in 2025?

- Increased use of smart technologies and Industry 4.0: The increased use of smart technologies and Industry 4.0 supports the market by enhancing automation, efficiency, and real-time monitoring, enabling manufacturers to optimize production and reduce downtime.

- Rising automation and robotics: Both robotic arms and automated inspection & feeding systems are being adopted more to cope with labor shortages and raise throughput.

- Strong focus on sustainability & eco-friendly materials: Biodegradable, recyclable packaging, plant-based plastics, mono-materials, paper/fiber-based solutions are growing in demand.

- Flexible packaging gaining importance: The growing importance of flexible packaging supports the market by driving demand for advanced, adaptable machinery capable of handling varied materials and complex packaging formats.

- Innovation in sealing, wrapping and filling techniques: Innovation in sealing, wrapping, and filling techniques are enhancing packaging quality.

- Regulatory push and consumer expectations: Japan’s environmental regulations, along with consumer preferences, are driving packaging to be more sustainable, recyclable, and less wasteful.

- Customization & flexibility: The trend of customization and flexibility supports the market by driving demand for adaptable machines that can efficiently handle diverse product types, sizes, and packaging formats to meet evolving consumer and industry needs.

If there is anything you’d like to ask, feel free to get in touch with us @ sales@towardspackaging.com

What Potentiates the Growth of the Japan Packaging Machinery Market?

Expansion of E-Commerce and Consumer Goods Industries

The rapid growth of e-commerce and consumer goods industries in Japan is significantly driving the market by creating strong demand for efficient, flexible, and protective packaging solutions. With the surge in online shopping, products require secure and durable packaging that can withstand handling and transportation, leading to increased use of advanced filling, sealing, and labeling machines. Consumer goods companies are also adopting automated and customizable machinery to meet diverse packaging needs, enhance brand appeal, and ensure quick delivery. This shift not only boosts operational efficiency but also fuels continuous innovation in Japan’s packaging machinery industry.

- In October 2025, Speed Roll Co., Ltd. plans to showcase three automatic packaging machines at JAPAN PACK 2025, designed specifically for e-commerce logistics. These machines include a bagging system for cushioned envelopes, an automatic sealing & labeling system for cartons of various sizes, and a hybrid paper bagging system.

Limitations & Challenges in the Japan Packaging Machinery Market

Labor Shortage & Limited Flexibility

The key players operating in the market are facing issues due to labor shortages, fluctuating demand, and competition from low-cost suppliers. Labor shortages affect skilled workforce availability for operating and maintaining advanced machinery. The limited flexibility of traditional machines restricts adaptation to new and changing packaging formats, affecting market growth.

Country-Level Analysis

Japan stands as a dominant force in the global packaging machinery industry, driven by several key factors. The country’s strong emphasis on automation and technological innovation has led to the development of advanced packaging solutions, enhancing efficiency and precision across various industries. Additionally, Japan’s robust manufacturing infrastructure and adherence to high-quality standards ensure the production of reliable and durable packaging machinery. The country’s commitment to sustainability and eco-friendly practices has also spurred the adoption of recyclable and biodegradable packaging materials, aligning with global environmental trends. Furthermore, Japan’s strategic position in the Asia-Pacific region facilitates access to emerging markets, bolstering its leadership in the packaging machinery sector.

Future of Packaging Machinery Market

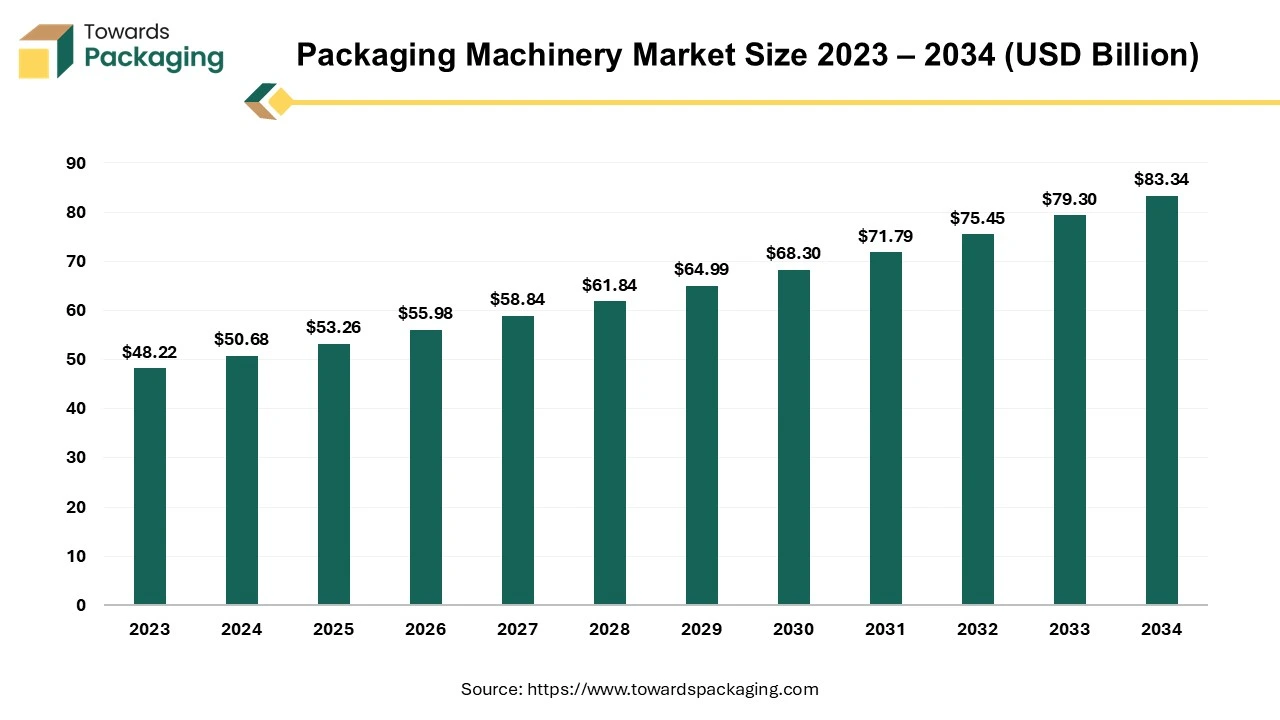

The packaging machinery market is projected to reach USD 83.34 billion by 2034, expanding from USD 53.26 billion in 2025, at an annual growth rate of 5.1% during the forecast period from 2025 to 2034.

Packaging machinery is the machinery used to package and protect goods inside containers to be sold, distributed, shipped, stored, and used. This procedure is essential to marketing because it guarantees that products are displayed appropriately and communicate the intended image and design. “Packaging equipment” refers to the machinery that quickly and effectively places goods into wrappings or containers for protection.

Future of Cosmetic Packaging Machinery Market

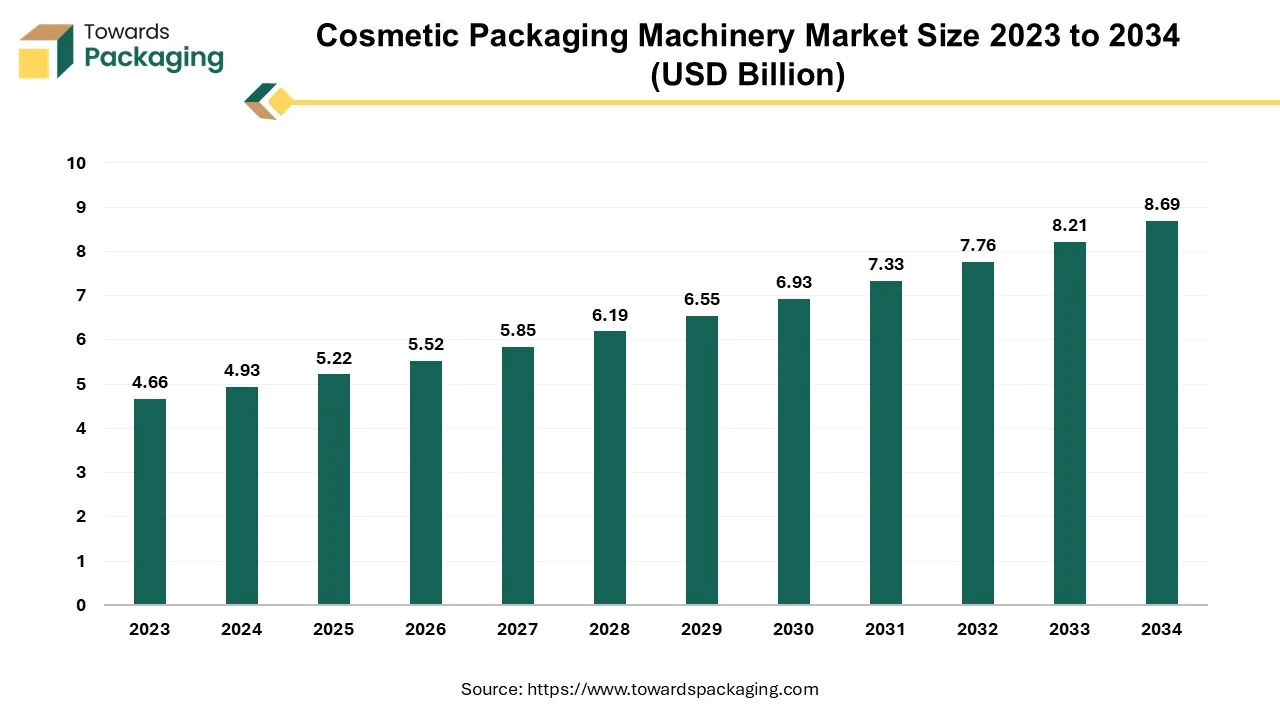

The cosmetic packaging machinery market is expected to grow from USD 5.22 billion in 2025 to USD 8.69 billion by 2034, with a CAGR of 5.83% throughout the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition to develop innovative cosmetic packaging technology which is expected to drive the growth of the cosmetic packaging machinery market over the forecast period. The global packaging market to grow at a 3.16% CAGR between 2025 and 2034.

A product applied to the body to enhance beauty or conceal a flaw is referred to as cosmetics. These goods can include nail polish, face creams, skin lotions, shampoo, and other cosmetics like lipstick and eye shadow. Under a broad definition, even toothpaste and perfumes may be categorized as cosmetic products. The cosmetics sector uses a wide range of packaging machinery to prepare its products for sale, as well as a vast variety of packaged goods.

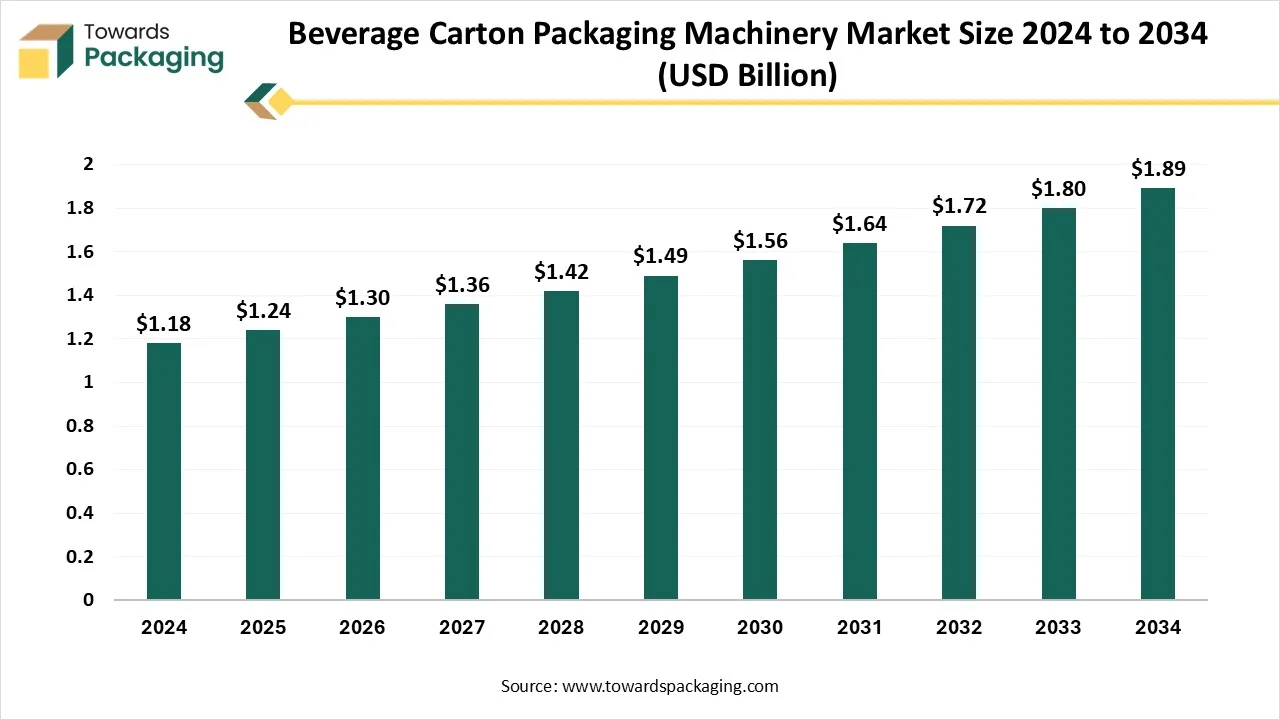

Future of Beverage Carton Packaging Machinery Market

The global beverage carton packaging machinery market is anticipated to grow from USD 1.24 billion in 2025 to USD 1.89 billion by 2034, with a compound annual growth rate (CAGR) of 4.81% during the forecast period from 2025 to 2034.

The increasing awareness of sustainability, growing demand for lightweight packaging, a surge in beverage consumption, rapid expansion of the e-commerce sector, rising environmental concerns, and a shift toward recyclable materials are expected to drive the global beverage carton packaging machinery market over the forecast period. Automation, high-speed systems, and modular packaging lines are key trends shaping the future of this market. Sustainability and environmental consciousness are playing a crucial role in transforming the beverage carton packaging machinery market.

The beverage carton packaging machinery market includes the design, production, and sale of machinery used for forming, filling, sealing, and secondary packaging of beverages in carton-based formats. Beverage carton packaging machinery plays a crucial role in the global food and beverage industry. With the rising consumer demand for packaged beverages, the need for efficient, sustainable, and cost-effective packaging continues to grow. These machines are integral to the processing of dairy products, juices, plant-based drinks, alcoholic beverages, and water in gable-top, brick, and aseptic cartons.

More Insights of Towards Packaging:

- Bagging Machines Market Trends, Disruptors, Competitive Strategy and Role of Key Players – The bagging machines market is forecast to grow from USD 14.43 billion in 2025 to USD 27.21 billion by 2034, driven by a CAGR of 7.3% from 2025 to 2034.

- Snack Packaging Machine Market 2025 to 2034 USD 19.56 Billion to USD 29.39 Billion Growth with Rising Packaged Snack Demand – The snack packaging machine market is projected to reach USD 29.39 billion by 2034, expanding from USD 19.56 billion in 2025.

- Pharmaceutical Packaging Machines Market Driven by AI, Smart Tech, and USD 13.63 Billion Forecast – The pharmaceutical packaging machines market is expected to increase from USD 7.04 billion in 2025 to USD 13.63 billion by 2034.

- Vial Cap Sealing Machine Market Amid Surge in Injectable Drug Production – The vial cap sealing machine market is projected to reach USD 1161.02 million by 2034, expanding from USD 781.48 million in 2025.

- Wet Glue Labelling Machine Market Driven by 4.93% CAGR – The wet glue labelling machine market is projected to reach USD 5.89 billion by 2034, expanding from USD 3.82 billion in 2025.

- Vertical Form-Fill-Seal (VFFS) Machines Market Strategic Growth, Innovation & Investment Trends – The global vertical form-fill-seal (VFFS) machines market size reached US$ 2.78 billion in 2024 and is projected to hit around US$ 5.32 billion by 2034.

- Sachet Packaging Machines Market Intelligence Report, Key Trends, Innovations & Market Dynamics – The global sachet packaging machines market is expected to increase from USD 638.91 million in 2025 to USD 842.23 million by 2034.

- PET Bottle Blow Molding Machine Market 2025 Insights: Injection Blow Segment Leads, Asia Pacific to Grow Fastest by 2034 – The global PET bottle blow molding machine market was valued at USD 10.33 billion in 2024 and is projected to reach USD 14.22 billion by 2034.

- Pharma Blister Packaging Machines Market Drives at 2.85% CAGR – The pharma blister packaging machines market is projected to grow from USD 2.37 billion in 2024 to USD 3.13 billion by 2034.

- Premix Packaging Machine Market Dynamics, Competitive Forces & Strategic Pathways – The global premix packaging machine market was valued at USD 1.3 billion in 2024 and is projected to grow to USD 1.915 billion by 2034.

- Wrap-Around Cartoning Machines Market Research Insight: Industry Insights, Trends and Forecast – The wrap-around cartoning machines market is expected to increase from USD 1.66 billion in 2025 to USD 2.11 billion by 2034.

- HFFS Pouching Machines Market Research, Consumer Behavior, Demand and Forecast – The HFFS pouching machines market is experiencing rapid growth, with projections estimating a revenue surge of hundreds of millions of dollars from 2025 to 2034.

- Cartoning Machines Market to Hit USD 13.58 Billion by 2034 Driven by Sustainable Packaging Demand – The cartoning machines market is projected to reach USD 13.58 billion by 2034, growing from USD 8.72 billion in 2025, at a CAGR of 5.05%.

- Ampule Sticker Labelling Machine Market Size, Demand, and Trends Analysis 2034 – The ampule sticker labelling machine market is experiencing significant growth, with revenue expected to surge into the hundreds of millions.

- Vacuum Sealing Machine Market Strategic Review, Key Business Drivers & Industry Forecast – The vacuum sealing machine market is forecast to grow from USD 1.15 billion in 2025 to USD 1.85 billion by 2034, driven by a CAGR of 4.85% from 2025 to 2034.

Segment Outlook

Machine Type Insights

The filling machines segment dominated the Japan packaging machinery market in 2024 due to their widespread application across food & beverages, pharmaceutical, and cosmetics industries. Rising demand for precise dosing, hygiene, and high-speed operations enhances adoption. Additionally, growing consumption of ready-to-eat meals and packaged products strengthens reliance on advanced filling technologies.

The palletizing machines segment is expected to grow at a significant rate in the upcoming period due to the rising need for automation in warehousing and logistics. These machines efficiently stack and organize packaged goods, improving handling, storage, and transportation. The growing e-commerce sector, large-scale food and beverage production, and labor-saving initiatives are further driving their adoption.

Packaging Type Insights

The primary packaging segment dominated the Japan packaging machinery market in 2024 due to its essential role in protecting products, maintaining hygiene, and ensuring shelf life across food, beverage, pharmaceutical, and cosmetic industries. Rising demand for convenient, safe, and visually appealing packaging drives the widespread adoption of advanced primary packaging machinery.

The secondary packaging segment is expected to grow at the fastest rate in the coming years due to increasing demand for efficient product grouping, transportation, and storage solutions. Automation in cartoning, case packing, and bundling enhances operational efficiency, while the growth of e-commerce and stricter logistics requirements drive the adoption of advanced secondary packaging machinery.

Technology Type Insights

The conventional packaging machinery segment remains dominant in the market due to its reliability, proven performance, and widespread use across established food, beverage, pharmaceutical, and consumer goods industries. Familiarity among operators, lower maintenance complexity, and compatibility with existing production lines continue to support its extensive adoption.

The robotic-enabled packaging machinery segment is expected to expand at the fastest rate during the forecast period, driven by rising demand for automation, labor shortages, and the need for high-speed and precise operations. Robotics enhances flexibility, efficiency, and accuracy in tasks such as picking, packing, palletizing, and labeling. The increasing adoption across the food, beverage, pharmaceutical, and e-commerce industries further accelerates growth in this advanced packaging technology segment.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results – schedule a call today: https://www.towardspackaging.com/schedule-meeting

Operation Speed Insights

The medium-speed (50–150 packs/min) segment dominated the Japan packaging machinery market in 2024. This is mainly due to its balance of efficiency and cost-effectiveness. It suits a wide range of industries, including food, beverage, and pharmaceuticals, providing reliable output with minimal energy and operational costs, making it ideal for medium-scale production requirements.

The high-speed (over 150 packs/min) segment is expected to grow at the highest CAGR over the projection period due to increasing demand for mass production, efficiency, and reduced labor dependency. Industries such as food, beverage, and pharmaceuticals are adopting advanced high-speed machines to meet large-scale production requirements, ensure faster throughput, and maintain consistent quality while supporting automation and modern manufacturing practices.

Material Compatibility Insights

The plastic-compatible (PET, PE, PP, PVC) segment dominated the Japan packaging machinery market in 2024 due to the widespread use of plastic packaging across food, beverage, pharmaceutical, and consumer goods industries. Plastic’s versatility, durability, and cost-effectiveness make it ideal for various packaging formats. Machinery compatible with plastic ensures efficient filling, sealing, and labeling, meeting industry demands for convenience, protection, and product integrity.

The paper & paperboard compatible segment is likely to grow at the fastest rate in the market due to increasing environmental awareness and demand for sustainable packaging solutions. Consumers and regulatory bodies are favoring recyclable, biodegradable, and eco-friendly materials, encouraging manufacturers to adopt machinery capable of handling paper and paperboard. This shift supports innovation in cartons, wraps, and folding packs, while aligning with corporate sustainability goals and reducing plastic dependency across food, beverage, and consumer goods industries.

End-Use Industry Insights

The food & beverages segment dominated the Japan packaging machinery market in 2024 due to the high demand for safe, hygienic, and efficient packaging solutions. Growing consumption of processed foods, ready-to-eat meals, and beverages drives adoption of advanced filling, sealing, labeling, and wrapping machinery. Additionally, the need for extended shelf life, product protection, and compliance with safety standards strengthens the segment’s market leadership.

The pharmaceutical segment is expected to grow at the fastest rate in the upcoming period due to increasing demand for safe, precise, and compliant packaging solutions. Stringent regulations on product safety, serialization, and tamper-evident packaging drive the adoption of advanced machinery for blister packs, bottles, and vials. Rising pharmaceutical production, growth in biologics and specialty drugs, and the need for automated, high-speed packaging to reduce errors and maintain quality further accelerate the uptake of sophisticated packaging machinery in this sector.

Access our exclusive, data-rich dashboard dedicated to the Japan Packaging Machinery Market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access Now: https://www.towardspackaging.com/contact-us

Recent Breakthroughs in the Market:

- At JAPAN PACK 2025, Neostarpack is set to showcase a one-operator modular packaging line designed for high-precision servo liquid filling, tablet/capsule counting, labeling, and capping. This system aims to enhance productivity and reduce labor costs across sectors like food & beverage, pharmaceuticals, cosmetics, and chemicals.

- In March 2025, Orihiro introduced its ‘Onpack Series’ packaging machine, focusing on aseptic packaging solutions. This development addresses the growing demand for long-life, sustainable packaging in food and chemical industries, aligning with Japan’s emphasis on eco-friendly practices.

- In September 2025, NASCO announced its participation in JAPAN PACK 2025, where it is set to present advanced packaging systems, including the VEMAG quantitative molding line and FANUC’s parallel link robot. These innovations aim to improve efficiency and automation in food processing and packaging.

- In June 2025, Nanjing Zhuoneng Machinery Equipment Co., Ltd. showcased its paper bag-making machine at JAPAN PACK 2025. This product aligns with the industry’s shift toward sustainable packaging solutions, catering to sectors such as beverages and packaging materials.

Japan Packaging Machinery Market Players

- Fuji Machinery Co., Ltd.

- Toyo Jidoki Co., Ltd.

- Ishida Co., Ltd.

- Omori Machinery Co., Ltd.

- Yamato Scale Co., Ltd.

- Nabtesco Corporation

- Toyo Seikan Group Holdings, Ltd.

- Mitsubishi Electric Corporation

- Fujifilm Corporation (via Toyo Ink SC Holdings)

- Shibuya Corporation

- Tsubakimoto Chain Co.

- Sanko Machinery Co., Ltd.

- Orient Machinery Co., Ltd.

- Maruho Hatsujyo Innovations

- Harpak-ULMA (Japanese JV)

- CKD Corporation

- Furukawa Mfg. Co., Ltd.

- Nichrome Japan

- Hisaka Works, Ltd.

- Tohoku Electric Mfg. Co., Ltd.

Japan Packaging Machinery Market Segmentations

By Machine Type

- Filling Machines

- Liquid

- Powder

- Granules

- Wrapping Machines

- Stretch Wrapping

- Shrink Wrapping

- Overwrapping

- Labeling Machines

- Pressure-sensitive

- Sleeve Labeling

- Glue-based Labeling

- Form-Fill-Seal (FFS) Machines

- Vertical FFS

- Horizontal FFS

- Sealing Machines

- Induction Sealing

- Heat Sealing

- Ultrasonic Sealing

- Cartoning Machines

- Palletizing Machines

- Robotic

- Conventional

- Case Packing Machines

- Capping Machines

- Coding & Marking Machines

- Inspection Machines

- Checkweighers

- Metal Detectors

- X-ray Inspection

By Packaging Type

- Primary Packaging

- Rigid (bottles, cans, jars)

- Flexible (pouches, sachets, bags)

- Secondary Packaging

- Cartons

- Trays

- Tertiary Packaging

- Pallets

- Crates

- Shrink Wrap Bundles

By Automation Level

- Manual

- Semi-Automatic

- Automatic

By End-Use Industry

- Food & Beverage

- Dairy

- Confectionery

- Ready-to-Eat Meals

- Bottled Drinks

- Frozen Foods

- Pharmaceuticals (Fastest growing)

- Cosmetics & Personal Care

- Chemicals

- Industrial/Automotive

- Consumer Electronics

- E-Commerce & Logistics

By Technology Type

- Conventional Packaging Machinery

- Robotics-Enabled Packaging Machinery

- IoT/Smart Packaging Machinery

- Vacuum Packaging

- Modified Atmosphere Packaging (MAP)

By Operation Speed

- Low Speed (<50 packs/min)

- Medium Speed (50–150 packs/min)

- High Speed (>150 packs/min)

By Material Compatibility

- Plastic Compatible (PET, PE, PP, PVC)

- Metal Compatible (aluminum, tinplate)

- Glass Compatible

- Paper & Paperboard Compatible (Fastest growing)

- Biodegradable & Compostable Material Compatible

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/price/5708

Become a Valued Research Partner with Us – Schedule a meeting: https://www.towardspackaging.com/schedule-meeting

Request a Custom Case Study Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Towards Packaging, Your Trusted Research and Consulting Partner, Has Been Featured Across Influential Industry Portals – Explore the Coverage:

- Flexible Packaging Market – PACKNODE

- Is it finally safe to ditch your phone case? I put it to the test

- Battery Brands Charge Forward with Plastic-Free Packaging

- Why Non-corrugated Boxes Are the Future of Packaging

- Ampoules Packaging Market Size Expected to Reach $11.27 Bn by 2034

- Flexible plastic pouches projected to boom over the next decade

- GLOBAL PET FOOD PACKAGING MARKET SET TO DOUBLE BY 2032

- The Skinny on the Skin Packaging Market

- Healthcare Goes Green & Sterile

- The Different Types of Adhesives for Paper Packaging

- Child-Resistant Packaging: Cannabis and So Much More

Towards Packaging Releases Its Latest Insight – Check It Out:

- Paper Machinery Market Investment Opportunities & Competitive Benchmarking

- Labeling Machine Market Driven by 3.84% CAGR (2025-34)

- Packaging Machinery Market 2025 Growth Fueled by Asia-Pacific and Filling Machine Innovations

- E-Commerce Packaging Market Investment Opportunities & Competitive Benchmarking

- Recyclable Packaging Market Key Trends, Disruptions and Strategic Imperatives

- Pharmaceutical Temperature Controlled Packaging Solutions Market Investment Opportunities & Competitive Benchmarking

- Ready-To-Drink Packaging Market Size and Growth 2034

- Mushroom Packaging Market Trends, Growth, and Market Size Analysis 2034

- Liquid Packaging Market Size, Trends, Share, and Innovations 2034

- Agriculture Packaging Market Growth and Regional Production Analysis

- Seaweed Packaging Market Size, Share, Trends, and Forecast Analysis 2034

- Tobacco Packaging Market Growth, Demand, and Production Forecast 2034

- Protective Packaging Market Driven by 4.6% CAGR (2025-34)

- Interactive Packaging Market Insights, Forecast and Competitive Strategies

- Liquid IBC Market Research Insight Industry Insights, Trends and Forecast